The Pros and Cons of Using Crypto Cards for Everyday Purchases

In recent years, cryptocurrency has become increasingly popular as a way to make everyday purchases online. With the rise of online shopping, crypto cards have emerged as a viable alternative to traditional payment methods like PayPal and credit cards. But are crypto cards right for you? Let’s dive into the pros and cons of using crypto cards for everyday purchases.

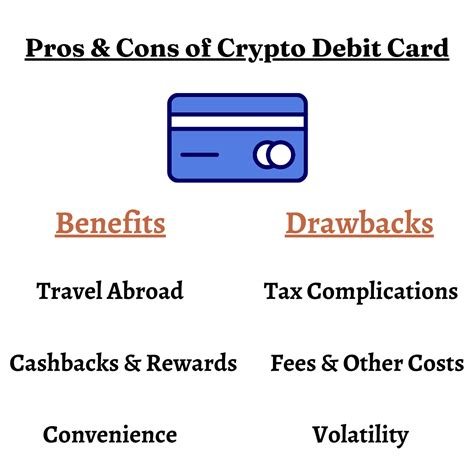

Pros:

- Increased Security: Crypto cards use blockchain technology to create an immutable record of every transaction, making it virtually impossible to hack or steal your money.

- anonymity: With a crypto card, your personal and financial information is not shared with the merchant or online retailer, providing a high level of anonymity.

- Convenience: Many merchants now accept crypto cards, which can be purchased through various online platforms like BitPay, Coinbase, and Crypto.com.

- Low transaction fees: Transaction fees on crypto cards are often significantly lower than those on traditional payment methods.

- Wide acceptance: Crypto cards have been accepted by thousands of businesses, including restaurants, cafes, and retailers.

Cons:

- Initial Investment

: The initial investment required to buy a crypto card can be high, ranging from $100 to over $500.

- Market volatility: The value of cryptocurrencies like Bitcoin can fluctuate rapidly, making it difficult to predict the future worth of your crypto card balance.

- Limited merchant acceptance: Not all merchants accept crypto cards, which can limit your purchasing power in certain situations.

- Limited rewards

: Crypto cards typically offer rewards or discounts based on your purchases, but these may not be as valuable as those offered by traditional payment methods.

- Regulatory uncertainty: The regulatory environment surrounding crypto cards is still evolving, and it’s unclear what the future holds for these transactions.

Who Should Consider Using a Crypto Card?

- Investors or traders: If you’re an investor or trader who frequently makes online purchases, a crypto card can provide additional security and anonymity.

- Online shoppers: If you shop online regularly, a crypto card can be a convenient alternative to traditional payment methods like PayPal or credit cards.

- Travelers: Travelers may find it easier to use a crypto card while abroad, as many countries have a high level of adoption for cryptocurrency.

Who Should Avoid Using a Crypto Card?

- Casual online shoppers: If you only make occasional purchases online, you might not need the added security and anonymity provided by a crypto card.

- Small businesses: Some small businesses may not accept crypto cards, so it’s essential to check their policies before using one.

Conclusion:

Crypto cards can be a great way to add an extra layer of security and convenience to your online purchases. However, it’s essential to weigh the pros and cons carefully before deciding whether to use a crypto card. With the right understanding of the benefits and limitations, you can make informed decisions about which type of payment method is best for your needs.

Tips for Using Crypto Cards:

- Research merchants: Before purchasing a crypto card, research the merchant’s policies and acceptance.

- Understand fees: Understand all fees associated with the crypto card, including transaction fees and any annual management fees.

- Keep records: Keep records of your purchases and transactions to ensure you can track your funds.

In conclusion, using a crypto card can be a great way to add an extra layer of security and convenience to your online purchases. While there are pros and cons to consider, the benefits often outweigh the drawbacks for those who use them regularly.