Ethereum: Binance, CCXT Futures, Setting the Amount, and Scaling Up

As an Ethereum enthusiast, you are probably familiar with the exciting world of trading futures contracts on the blockchain. In this article, we will delve into a common challenge that many users encounter when trying to make large trades: setting the correct amount.

What is CCXT?

CCXT (Commodity Currencies Trading Exchange) is a popular platform for buying and selling cryptocurrency derivatives, including futures contracts. As the name suggests, CCXT focuses on commodity-based currencies, such as gold, silver, and Bitcoin, but it also supports other cryptocurrencies.

Problem: Setting the Correct Amount

When setting an order, there are several factors that can affect the amount you are trying to execute:

- Order Type: Different order types have varying price limits. For example, a market order typically has no size limit, while a limit order may allow you to specify a maximum number of units.

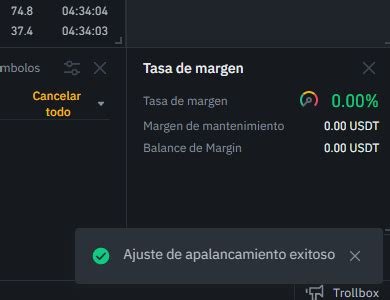

- Leverage: Leverage, or the ratio of your deposit to potential profit, can also impact the amount you are trying to execute. Higher leverage comes with greater risk but potentially greater profit.

- Fees: CCXT charges various fees for executing orders, including the base fee and any additional fees for trading on specific markets (e.g., futures).

- Order Size: The number of units you are trying to buy or sell can also impact the amount.

Setting the Amount on Binance: A Simple Example

Let’s say you want to buy 100 BTC at $40,000 using Binance Futures. Here’s a simplified example:

- Set the desired order type (e.g., market) and price ($40,000).

- Choose your leverage (for example, 5x).

- Select the contract size (in this case, 100 units).

In Binance, you can set the amount using the “Amount” field in the order form:

Order Type: Limit Order

Leverage: 5x

Contract Size: 100

Amount: $40,000

The Problem

As we have seen, setting the right amount is crucial to successful trading. However, this can be a challenge, especially for larger orders.

Tips for Expansion on CCXT

To overcome the problem of setting the right amount, here are some tips:

- Use Leverage Wisely

: High leverage can amplify your gains but also increase your risk. Before using it, make sure you understand the implications.

- Choose the right order type: Market orders may be sufficient for smaller trades, while limit orders may be more suitable for larger amounts.

- Monitor your fees: Learn about the fees associated with each market and adjust your strategy accordingly.

- Evaluate automated trading: If you are new to CCXT or futures trading, consider using an automated trading platform that can help you set up and execute trades at optimal levels.

Conclusion

Setting the right amount is a common challenge for cryptocurrency traders, including those on CCXT. By understanding the factors that impact order sizes and leverage, you can better address these challenges. Remember to always monitor your fees and adjust your strategy as needed to maximize profits while minimizing risk. Happy trading!